Navigating the Future of Estate Planning: WillMaker and Trusts in 2024

Related Articles: Navigating the Future of Estate Planning: WillMaker and Trusts in 2024

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Future of Estate Planning: WillMaker and Trusts in 2024. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future of Estate Planning: WillMaker and Trusts in 2024

The landscape of estate planning is constantly evolving, driven by changes in tax laws, societal trends, and technological advancements. In 2024, individuals and families are faced with a complex web of considerations as they navigate the process of securing their legacies. This article aims to provide a comprehensive overview of the role of WillMaker and trusts in the current estate planning landscape, highlighting their significance and benefits in a clear and informative manner.

Understanding the Basics: WillMaker and Trusts

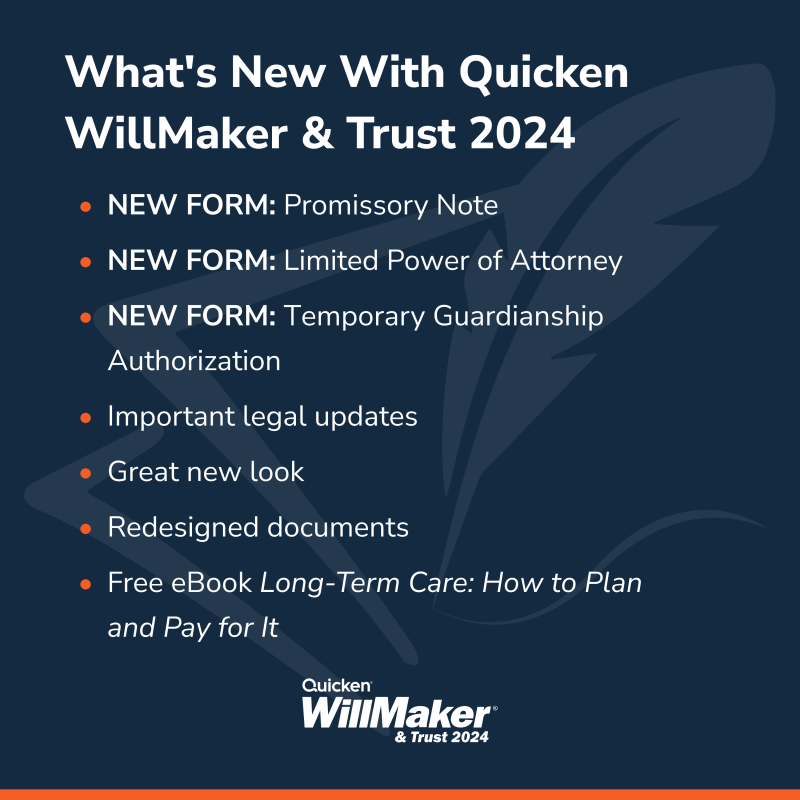

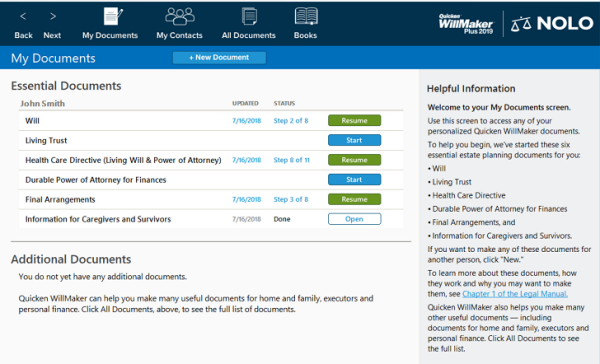

WillMaker: A WillMaker is a software program or online service that allows individuals to create their own wills without the assistance of an attorney. These platforms often provide templates and guidance to help users navigate the legal requirements of will creation. While cost-effective, WillMaker solutions may not be suitable for complex estate situations or those involving significant assets.

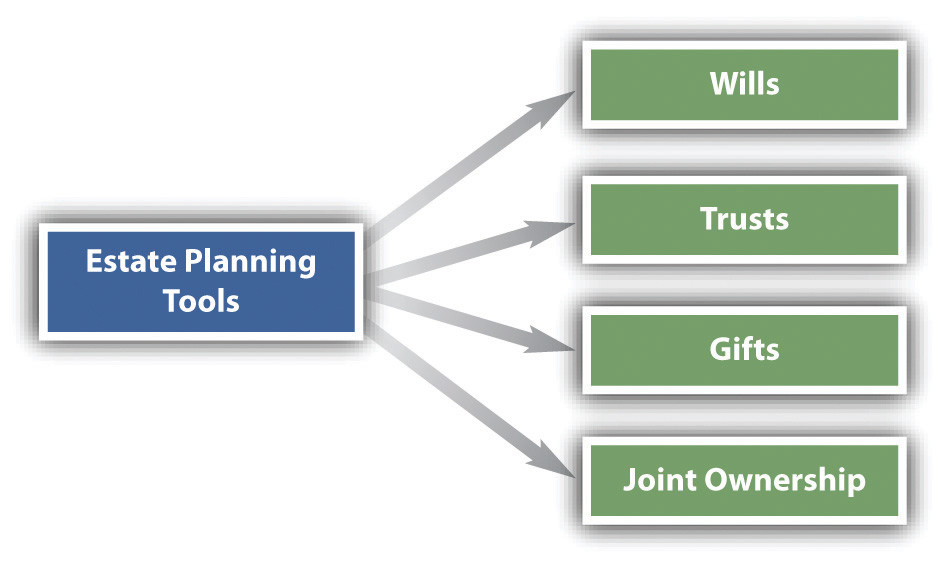

Trusts: A trust is a legal arrangement where a person (the "trustee") holds assets for the benefit of another person (the "beneficiary"). Trusts offer numerous advantages, including asset protection, tax benefits, and control over asset distribution after death. Different types of trusts cater to specific needs, such as revocable living trusts, irrevocable trusts, and charitable trusts.

The Intersection of WillMaker and Trusts in 2024

In 2024, the relationship between WillMaker and trusts is becoming increasingly intertwined. While WillMaker can assist with creating basic wills, the growing complexity of estate planning often necessitates the involvement of trusts. Here’s why:

- Tax Implications: Trusts can be utilized to minimize estate taxes and maximize tax benefits for beneficiaries. This is particularly relevant for individuals with substantial assets, as the estate tax exemption limits are subject to change.

- Asset Protection: Trusts can shield assets from creditors, lawsuits, and potential financial instability. This is crucial for individuals with high-net-worth or vulnerable assets.

- Control over Distribution: Trusts allow individuals to specify how their assets will be managed and distributed after their passing, ensuring their wishes are honored.

- Special Needs Planning: Trusts can be tailored to protect the assets of beneficiaries with special needs, ensuring their well-being and financial security.

The Importance of Professional Guidance

While WillMaker platforms offer accessibility and convenience, it’s crucial to understand their limitations. For complex estate situations, seeking professional legal advice from an experienced estate planning attorney is highly recommended. Attorneys can:

- Analyze individual circumstances: They can assess your specific needs, assets, and family dynamics to determine the most suitable estate planning strategies.

- Draft comprehensive documents: Attorneys possess the expertise to draft legally sound and tailored wills, trusts, and other estate planning instruments.

- Navigate legal complexities: They can provide guidance on tax laws, probate procedures, and other relevant legal matters.

- Ensure compliance: Attorneys ensure that your estate plan aligns with local laws and regulations.

FAQs Regarding WillMaker and Trusts in 2024

1. Can I use WillMaker to create a trust?

While some WillMaker platforms offer basic trust templates, they may not cover the full range of trust options or address complex legal considerations. It’s generally advisable to consult with an attorney for trust creation.

2. What are the different types of trusts?

Common trust types include:

- Revocable Living Trust: This type allows you to retain control over your assets during your lifetime and can be modified as needed.

- Irrevocable Trust: This type offers greater asset protection and tax benefits but limits your control over the assets.

- Charitable Trust: This type is designed to support charitable causes and can provide tax advantages.

3. Do I need a trust if I use WillMaker?

Whether you need a trust depends on your individual circumstances. If you have complex assets, significant wealth, or desire specific asset protection, a trust may be necessary.

4. How much does it cost to create a trust?

The cost of creating a trust varies depending on its complexity and the attorney’s fees. It’s recommended to consult with multiple attorneys for quotes and compare their services.

5. What are the advantages of using a trust?

Trusts offer numerous benefits, including:

- Asset protection: Trusts can shield assets from creditors and lawsuits.

- Tax advantages: Trusts can minimize estate taxes and maximize tax benefits for beneficiaries.

- Control over distribution: Trusts allow you to specify how your assets will be distributed after your passing.

- Privacy: Trusts can help maintain privacy regarding your assets and beneficiaries.

Tips for Estate Planning in 2024

- Review your existing estate plan: It’s essential to regularly review your estate plan and update it as needed to reflect changes in your life, assets, and family dynamics.

- Consider the impact of tax laws: Keep abreast of current and potential changes in tax laws, as they can significantly impact your estate plan.

- Seek professional advice: For complex estate situations, consulting with an experienced estate planning attorney is crucial to ensure your plan aligns with your goals and legal requirements.

- Communicate with your beneficiaries: It’s important to inform your beneficiaries about your estate plan and ensure they understand its provisions.

Conclusion

In 2024, estate planning is more crucial than ever. While WillMaker platforms offer a convenient way to create basic wills, the growing complexity of estate needs often necessitates the involvement of trusts. By understanding the benefits of trusts and seeking professional guidance, individuals can navigate the future of estate planning with confidence, ensuring their legacies are protected and their wishes are fulfilled.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future of Estate Planning: WillMaker and Trusts in 2024. We thank you for taking the time to read this article. See you in our next article!