Navigating the Complexities of Estate Planning: A Comprehensive Guide to Willmaker Software

Related Articles: Navigating the Complexities of Estate Planning: A Comprehensive Guide to Willmaker Software

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Complexities of Estate Planning: A Comprehensive Guide to Willmaker Software. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Complexities of Estate Planning: A Comprehensive Guide to Willmaker Software

The process of estate planning, while essential, can often feel daunting. It involves confronting difficult decisions about the future distribution of assets, the appointment of guardians for minor children, and the potential for minimizing estate taxes. While legal counsel remains crucial for complex estate situations, the advent of willmaker software has provided individuals with a powerful tool to streamline and simplify the process of creating legally sound and personalized estate planning documents.

Understanding the Essence of Willmaker Software

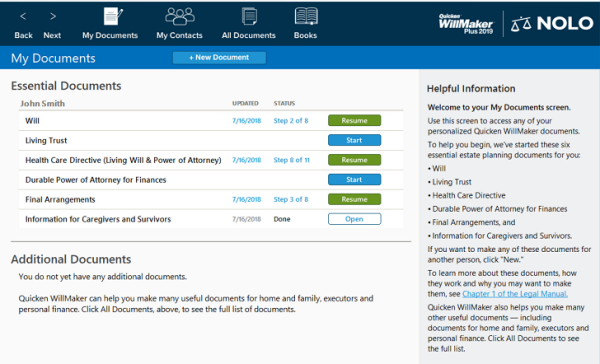

Willmaker software, essentially, acts as a digital guide, offering a user-friendly interface to assist individuals in creating legally valid wills, trusts, and other estate planning documents. These programs are designed to walk users through a series of questions, guiding them in defining their wishes and preferences for the distribution of their assets, the appointment of beneficiaries, and the designation of guardians for minor children.

Key Features and Benefits of Willmaker Software

1. Accessibility and Convenience:

Willmaker software eliminates the need for time-consuming and potentially costly consultations with legal professionals for basic estate planning needs. Users can access the software online or via downloadable programs, allowing them to create their documents at their own pace and convenience.

2. Personalized Estate Planning:

The software’s interactive nature allows users to customize their documents to reflect their specific circumstances and preferences. They can choose from a variety of pre-defined clauses and templates, tailoring them to suit their individual needs and ensuring that their wishes are accurately reflected in their legal documents.

3. Legal Compliance and Accuracy:

Willmaker software is developed by legal professionals and regularly updated to comply with current estate planning laws. This ensures that the generated documents meet the legal requirements of the user’s jurisdiction, minimizing the risk of legal challenges or disputes.

4. Cost-Effectiveness:

Compared to the fees associated with traditional estate planning services, willmaker software offers a significantly more cost-effective solution. Users can create their legal documents for a fraction of the cost, making estate planning accessible to a wider audience.

5. Educational Value:

The process of using willmaker software can be inherently educational, providing users with a deeper understanding of estate planning concepts, terminology, and legal requirements. This knowledge can empower individuals to make informed decisions about their estate planning needs and ensure their wishes are effectively communicated.

Types of Estate Planning Documents Created by Willmaker Software

Willmaker software typically enables users to create a range of estate planning documents, including:

-

Wills: The cornerstone of estate planning, a will outlines the distribution of assets upon the testator’s death. It designates beneficiaries, appoints executors, and may include provisions for minor children or charitable donations.

-

Living Wills: Also known as advance healthcare directives, living wills express an individual’s wishes regarding medical treatment in the event of terminal illness or incapacitation.

-

Durable Powers of Attorney: These documents authorize a trusted individual to make financial and legal decisions on behalf of the grantor in the event of incapacity.

-

Revocable Living Trusts: Trusts can be used to transfer assets during the grantor’s lifetime, potentially minimizing estate taxes and providing for asset management after death.

-

Beneficiary Designations: These documents specify how assets held in retirement accounts, life insurance policies, and other financial instruments should be distributed upon the owner’s death.

Factors to Consider When Choosing Willmaker Software

While the convenience and affordability of willmaker software are undeniable, careful consideration should be given to factors such as:

-

Legal Jurisdiction: Ensure that the software complies with the specific estate planning laws of the user’s state or jurisdiction.

-

Features and Templates: The software should offer a comprehensive range of features and templates to address the user’s specific needs and estate planning goals.

-

Customer Support: Access to reliable customer support can be crucial in case of technical difficulties or questions about the software’s functionality.

-

Reviews and Reputation: Research user reviews and ratings to assess the software’s reliability, accuracy, and user-friendliness.

FAQs Regarding Willmaker Software

1. Is Willmaker Software a Substitute for Legal Advice?

While willmaker software can provide a valuable tool for creating basic estate planning documents, it is not a substitute for professional legal advice. Complex estate situations, such as significant wealth, family disputes, or unique asset types, may require consultation with an experienced estate planning attorney.

2. How Secure is My Information When Using Willmaker Software?

Reputable willmaker software providers prioritize data security and employ encryption technologies to protect user information. However, it is essential to read the software’s privacy policy and ensure that it aligns with your personal security preferences.

3. Can I Modify or Update My Documents After Creating Them?

Most willmaker software allows users to modify and update their documents after creation. This flexibility ensures that the documents remain current and reflect any changes in circumstances or wishes.

4. What Happens If My Situation Changes After Creating My Documents?

It is advisable to review and update your estate planning documents periodically, particularly following significant life events such as marriage, divorce, birth of a child, or changes in financial circumstances.

Tips for Using Willmaker Software Effectively

-

Gather Relevant Information: Before starting the process, gather essential information such as asset details, beneficiary information, and contact details of potential executors and guardians.

-

Review and Understand the Terms and Conditions: Carefully review the software’s terms and conditions, including privacy policies and disclaimers, before proceeding.

-

Seek Professional Advice When Necessary: For complex estate planning needs or situations involving unique assets or legal complexities, consult with an experienced estate planning attorney.

-

Back Up Your Documents: Regularly back up your estate planning documents on multiple devices or secure cloud storage to ensure their safety and accessibility.

Conclusion

Willmaker software has revolutionized the accessibility and affordability of estate planning. While not a replacement for legal counsel, it offers a powerful tool for individuals to create legally sound and personalized estate planning documents. By carefully considering the factors outlined above, users can leverage this technology to ensure their wishes are effectively communicated and their loved ones are protected. Remember, proactively addressing estate planning needs is a crucial step in safeguarding your legacy and ensuring peace of mind for yourself and your family.

![Quicken WillMaker Plus 2012 [Download]: Create a complete estate plan](https://i.pinimg.com/originals/a4/c0/d0/a4c0d0c8dd6064616d265637537886c4.jpg)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Complexities of Estate Planning: A Comprehensive Guide to Willmaker Software. We appreciate your attention to our article. See you in our next article!