Navigating Estate Planning in 2023: Understanding Wills and Trusts

Related Articles: Navigating Estate Planning in 2023: Understanding Wills and Trusts

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Estate Planning in 2023: Understanding Wills and Trusts. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Estate Planning in 2023: Understanding Wills and Trusts

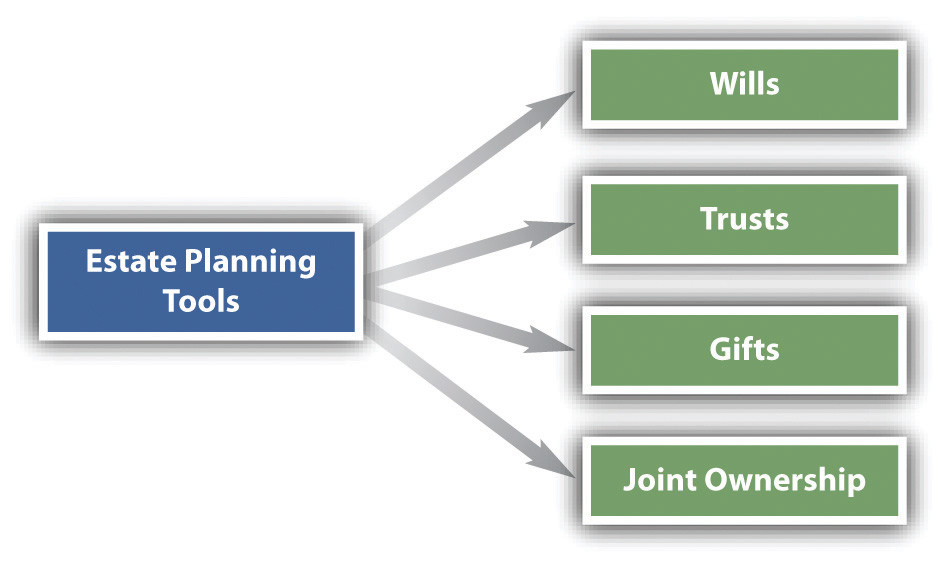

Estate planning is a crucial aspect of life, encompassing the legal and financial arrangements for the distribution of one’s assets after death. It ensures that your wishes are respected and protects your loved ones from unnecessary burdens. Two essential tools in estate planning are wills and trusts, both offering distinct advantages and serving specific purposes.

Wills: Defining Your Legacy

A will is a legal document that outlines how an individual’s assets will be distributed upon their death. It specifies the beneficiaries who will inherit property, financial accounts, and other possessions. A will also designates an executor, responsible for carrying out the terms of the will and managing the estate.

Key Features of a Will:

- Distribution of Assets: A will clearly designates the recipients of your assets and the specific portions they will receive.

- Appointment of Executor: You appoint a trusted individual to oversee the administration of your estate, ensuring your wishes are followed.

- Guardianship for Minors: If you have minor children, a will allows you to name a guardian who will care for them in your absence.

- Designation of Beneficiaries: You can name beneficiaries for specific assets, ensuring they receive what you intended.

Benefits of Creating a Will:

- Control Over Asset Distribution: A will provides a clear and legally binding document outlining how your assets will be distributed.

- Protection for Loved Ones: It safeguards your beneficiaries from legal disputes and ensures they receive the intended inheritance.

- Minimizing Taxes: A well-drafted will can help minimize estate taxes by strategically allocating assets.

- Peace of Mind: Knowing your wishes are documented and legally binding provides peace of mind, knowing your family will be taken care of.

Trusts: Safeguarding Your Assets and Beneficiaries

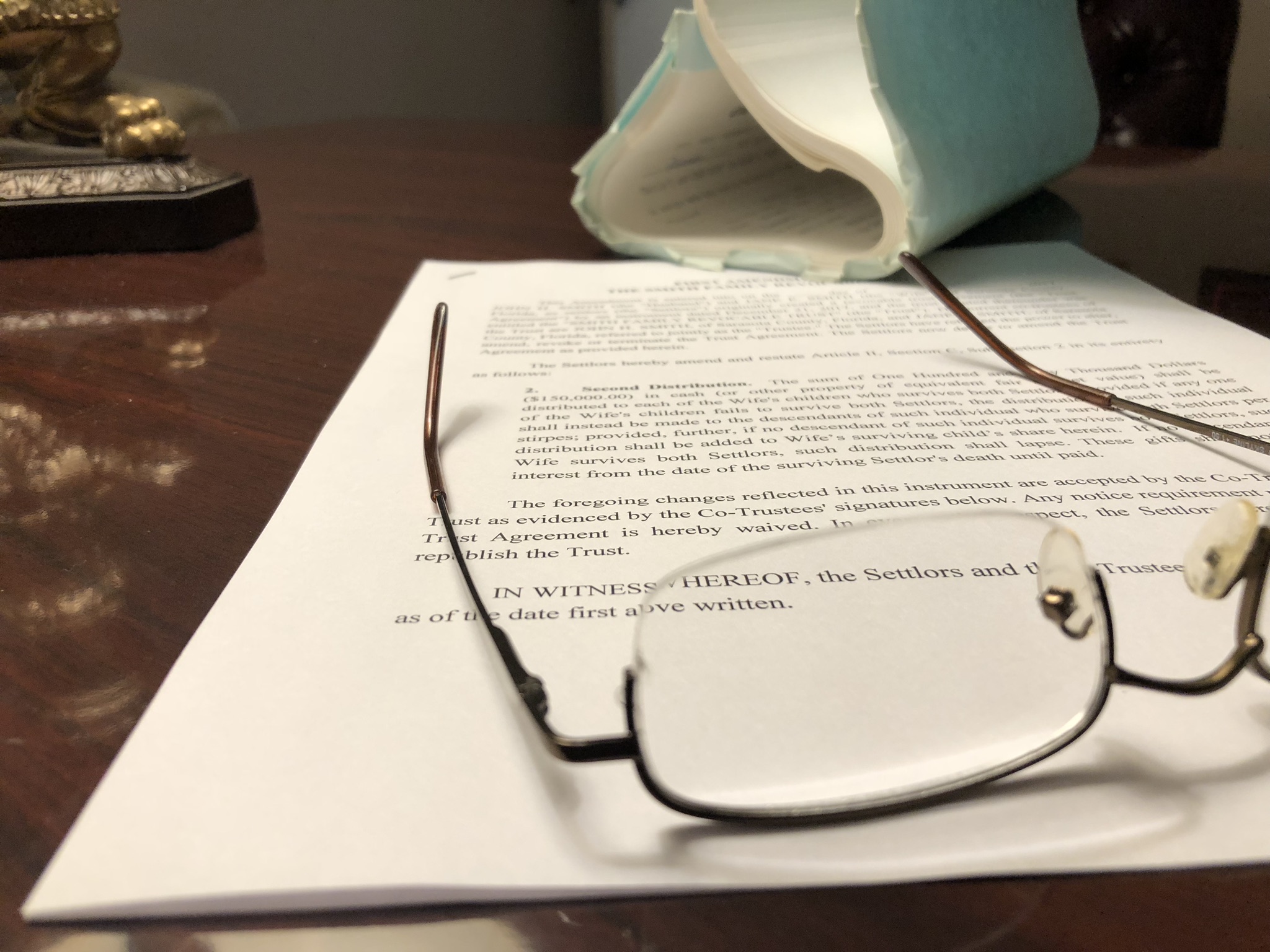

A trust is a legal arrangement where assets are held by a trustee for the benefit of a designated beneficiary. The trust agreement outlines how the assets will be managed and distributed. Trusts offer various benefits, including asset protection, tax advantages, and control over asset distribution.

Types of Trusts:

- Revocable Living Trust: The grantor retains control over the trust assets during their lifetime and can modify or revoke the trust at any time.

- Irrevocable Living Trust: The grantor relinquishes control over the trust assets once the trust is established, making it more difficult to modify or revoke.

- Testamentary Trust: A trust created through a will, taking effect only upon the grantor’s death.

Benefits of Creating a Trust:

- Asset Protection: Assets held in a trust are generally shielded from creditors and lawsuits, protecting your estate.

- Tax Advantages: Trusts can help reduce estate taxes and minimize capital gains taxes.

- Control over Asset Distribution: You can specify how and when trust assets are distributed to beneficiaries.

- Beneficiary Protection: A trust can protect beneficiaries who are minors, incapacitated, or prone to financial mismanagement.

Understanding the Importance of Estate Planning

Estate planning is essential for everyone, regardless of age or wealth. It provides peace of mind, ensures your wishes are followed, and protects your loved ones.

Why is Estate Planning Crucial?

- Protecting Your Family: Estate planning ensures your family is financially secure and protected after your death.

- Avoiding Disputes: A well-defined plan minimizes the risk of family disputes over inheritance.

- Minimizing Taxes: Proper planning can help reduce taxes and ensure your beneficiaries receive the maximum benefit.

- Achieving Your Goals: Estate planning allows you to set specific goals for your assets and ensure they are met.

Factors to Consider in Estate Planning:

- Family Structure: The number of dependents, their ages, and their financial needs should be considered.

- Asset Holdings: The types and value of your assets, including real estate, investments, and personal property, need to be assessed.

- Financial Goals: Your financial goals, such as providing for your family, funding education, or charitable giving, should be included.

- Tax Implications: Understanding the tax implications of different estate planning strategies is crucial.

Frequently Asked Questions (FAQs)

Q: Who needs estate planning?

A: Everyone needs estate planning. It is not just for the wealthy. Even if you have limited assets, estate planning ensures your wishes are followed and your loved ones are protected.

Q: What is the difference between a will and a trust?

A: A will is a legal document that outlines how your assets will be distributed after your death. A trust is a legal arrangement where assets are held by a trustee for the benefit of a beneficiary.

Q: When should I start estate planning?

A: It is best to start estate planning as soon as possible. It is never too early to begin planning for the future.

Q: How do I choose an executor for my will?

A: Choose someone you trust, responsible, and capable of managing your estate. Consider their financial literacy, organizational skills, and commitment to carrying out your wishes.

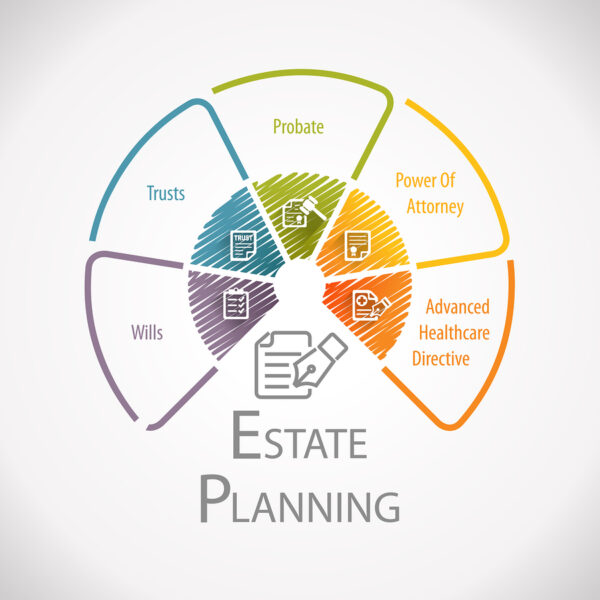

Q: What is probate?

A: Probate is the legal process of validating a will and distributing the deceased person’s assets.

Q: How can I avoid probate?

A: A living trust can help avoid probate. Assets held in a trust are distributed according to the trust agreement, bypassing the probate process.

Q: What are the benefits of using a lawyer for estate planning?

A: A lawyer can ensure your estate plan is legally sound, tailored to your specific circumstances, and compliant with relevant laws.

Tips for Effective Estate Planning

- Consult with an Estate Planning Attorney: Seek professional advice to ensure your plan is legally sound and meets your specific needs.

- Gather Relevant Documents: Collect important documents such as birth certificates, marriage licenses, social security cards, and financial statements.

- Review Your Plan Regularly: Life circumstances can change, so review your estate plan periodically to make necessary updates.

- Communicate with Beneficiaries: Inform your beneficiaries about your estate plan and discuss your wishes.

- Consider Charitable Giving: If you wish to make charitable donations, include them in your estate plan.

Conclusion

Estate planning is an essential step in safeguarding your legacy and providing for your loved ones. Whether you choose a will, a trust, or a combination of both, it is crucial to have a plan in place. By understanding the options available and seeking professional guidance, you can create a comprehensive and effective estate plan that meets your individual needs and ensures your wishes are fulfilled.

Closure

Thus, we hope this article has provided valuable insights into Navigating Estate Planning in 2023: Understanding Wills and Trusts. We appreciate your attention to our article. See you in our next article!